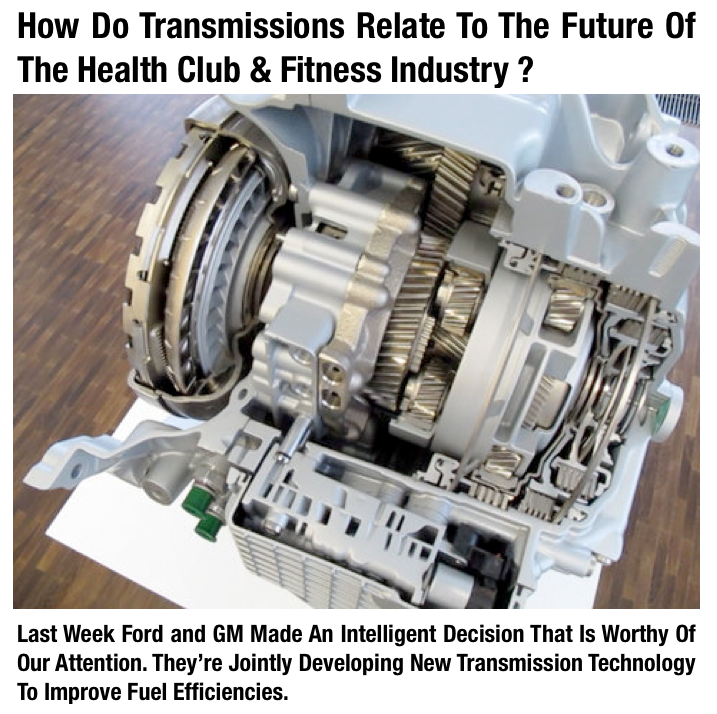

Collaboration: What Do Transmissions Have To Do With Health Clubs, and Fitness and Wellness ?

/

I’ve deep respect for so many of the leaders and innovators in the fitness, wellness and health club business. I don’t want to appear as though I’m kissing up by naming names (you know what i mean). But, and this is a BIG BUT, some of those on that list might be suffering from a little short sightedness. You see I think scarcity thinking is holding us back from big opportunities by working together with an abundance view in our industry. What does that mean ?

Ford and General Motors recently announced they are teaming up to design new nine-speed and 10-speed transmissions for use in a variety of vehicles, a move aimed at improving fuel efficiency for the rivals' vehicles. Now you might ask why would rivals work together to design technologies that can provide a strategic advantage ? Because they understand the big picture that’s why. In this case the big picture is dramatic impacts on fuel efficiency. This opportunity pressed against the cost of attempting to develop it alone leads rational business people to conclude working together is truly the best decision.

Enter the fitness and health club space where the largest and smallest of exercise equipment manufacturers seem focused on developing independent solutions for every opportunity. An example are technology platforms and interoperability among equipment brands. Outside of C-Safe , a technology standard created by FitLinxx and generously provided to the industry years ago, there has been little if ANY collaboration around this. The same could be said about many other aspects of the club business, and the fitness and wellness industries in general (not wanting to pick on you equipment folks alone) where fear of competitive advantage prohibits many from working together on universal standards as they could. From caloric burn rates to communication protocols, there is a lot of opportunity for us to agree and move things forward.

Now there have been collaborations. The NSF facility standards, for example, were recently agreed to after many many years of effort. IHRSA has been driving initiatives like the Public Policy Council which relies on contributions to promote public policy and legislative agendas that benefit the industry. FIT-C has started with a group of forward thinking people to create technology standareds. There has been some collaboration among various service providers as well. But its not been enough and that collaboration has taken to long in my view.

Looking at other industries provides many examples of the benefits of industry collaboration. Without a protocol like Wi-Fi there would not have been wide spread adoption of mobile computing. In the instance of WiFi, industry leaders created standards with a vision to what would be possible, like GM and Ford are today. They realized that the benefits of collaboration outweighed the cost because the work would grow the market considerably for everyone and at a faster pace.

What if competitors in our arena did more of the same: thought about opportunities for collaboration instead of identifying the uncommon ground? I just don’t think there is enough of that type of thinking in our industry today. Often people are too busy protecting their turf as opposed to seeing the bigger picture: the delivery of primary prevention as a larger commercial aspect of people’s health management in the future. If we are going to grow the market beyond the 16% of US adults using bricks and mortar fitness facilities in the US and in the rest of the world we will need to change our orientation. We will have to grow up and meet the promise of the future by seeing what that future will be and by working together to achieve it.

If we don’t spend more effort on this undertaking the risk will continue to rise. If we don’t collaborate more, organizations from outside our sphere are going to enter the space and meet the demand for services with technologies and business models that we weren’t contemplating. While free market economics allow for survival of the smartest and that is good,

What do you think ? Is there enough collaboration in the health club, fitness and wellness industry today ? Why do you think so ? Thanks for reading and feel free to contact me to discuss your views.

About the author:

Bryan O’Rourke is a health club industry expert, technologist, financier, shareholder and executive in several fitness companies. He works for Fitmarc, which delivers Les Mills programs to over 700 facilities in the US. He advises successful global brands, serves as a member of the GGFA Think Tank and serves as CEO of the Fitness Industry Technology Council. To join FIT-C visit www.fit-c.org . To learn more contact Bryan here today .