Fitness Industry Should Pay Attention to Changing Bookstore Biz Model

/ I am reading Jeff Trachtenberg's article in the WSJ this morning titled "E-Books Rewrite Bookselling". The article includes an important quote from Arthur Klebanoff, who is chief executive of New York-based RosettaBooks LLC, an e-book publisher. Arthur says "It's fair to say that the leadership folks at the major trade publishers didn't believe until very recently that e-books had any economic life in them." The important words here are "VERY recently".

I am reading Jeff Trachtenberg's article in the WSJ this morning titled "E-Books Rewrite Bookselling". The article includes an important quote from Arthur Klebanoff, who is chief executive of New York-based RosettaBooks LLC, an e-book publisher. Arthur says "It's fair to say that the leadership folks at the major trade publishers didn't believe until very recently that e-books had any economic life in them." The important words here are "VERY recently".

I write and lecture about radical change happening in business today with a particular emphasis on the fitness and wellness industry. What I attempt to share with leaders and organizations is that the rate of change is exponential, not linear as many of us assume. Jeff's article on how the E-Book business is revolutionizing bookselling illustrates the circumstances all business models are facing TODAY. Unfortunately, as with the book business, most industry leadership doesn't understand the true pace of radical change and therefore does not see the disruption coming until its to late. As Jeff explains:

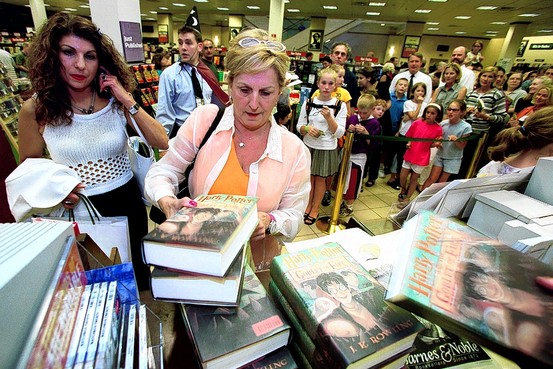

Nowhere is the e-book tidal wave hitting harder than at bricks-and-mortar book retailers. The competitive advantage Barnes & Noble spent decades amassing—offering an enormous selection of more than 150,000 books under one roof—was already under pressure from online booksellers. It evaporated with the recent advent of e-bookstores, where readers can access millions of titles for e-reader devices. Even more problematic for brick-and-mortar retailers is the math if sales of physical books rapidly decrease: Because e-books don't require paper, printing presses, storage space or delivery trucks, they typically sell for less than half the price of a hardcover book. If physical book sales decline precipitously, chain retailers won't have enough revenue to support all their stores.

Barnes and Noble has 1,362 stores, including 719 superstores with 18.8 million square feet of retail space: the equivalent of 13 Yankee Stadiums. That's a lot of fixed cost. As Jeff points out, Borders Group, the nation's second-largest book chain, saw same-store sales decline 14% at its superstores for the quarter ended Jan. 30. Of the 797 B. Dalton Booksellers stores that Barnes & Noble acquired in 1987, only four remain. And the number of independent booksellers continues to fall. As Indigo Books CEO Heather Reisman put it: "The days of filling the shelves and just opening the doors are gone."

Today the fitness industry is in a similar situation. Lots of high fixed costs and looming disruptive innovation. In an industry that loses almost half of its customer base each year, the days of filling a facility with equipment and just opening the doors are quickly coming to an end as well, but does anyone see what's coming? What is most telling, as identified in the WSJ article, was that Barnes and Noble was once a leader in the E-Book industry, investing in NuvoMedia in 1998. In a classic example of a market leader focusing on sustaining innovation as opposed to disruptive, the company abandoned the technology in 2003. B&N could have been the leader in E-books, but they gave up on the vision. Will leaders in the fitness industry make the same mistakes?

Watch and learn how new technologies are creating new innovations in publishing.