Near Term - The Enemy of Progress

/ Reading Harvard Business Review's blog "Is the U.S. Killing Its Innovation Machine" I am reminded of the continual challenge of quality managers and entrepreneurs : the need to balance the near and long term. In fact most, if not all, of the significant challenges facing organizations today result from the failing of leadership to convey the value of long term goals to stakeholders for fear of the near. The "Tyranny of the Ugent" as Hummel wrote.

Reading Harvard Business Review's blog "Is the U.S. Killing Its Innovation Machine" I am reminded of the continual challenge of quality managers and entrepreneurs : the need to balance the near and long term. In fact most, if not all, of the significant challenges facing organizations today result from the failing of leadership to convey the value of long term goals to stakeholders for fear of the near. The "Tyranny of the Ugent" as Hummel wrote.

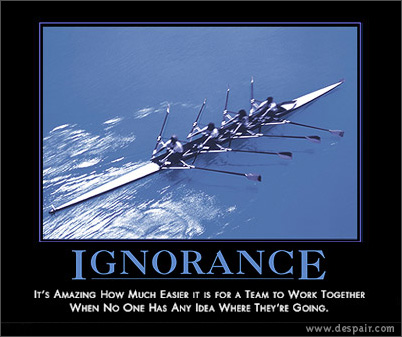

Its easy for people to "demand" results: particularly when there is so little understanding as to how those "results" might be achieved. Sadly many believe such demands are a sign of leadership: funny as that is. This is faulty thinking that is at the center of huge failings ( think GM and the recent Wall Street debacle as examples).

The principal role of intelligent leaders is to illuminate their organization's and industries about the need to choose between the status quo and a future of greater potential. As the article, "Pleasing Wall Street is a Poor Excuse for Bad Decisions" put it: good decisions rarely have much to do with the near term. No matter if you are a public or private enterprise, for profit or not for profit, the near term result should never be driven at the cost of the big picture. Dr. Ed Catmull, founder of Pixar, who wrote the article notes, among other things:

Managers who focus on maximizing short-term profits end up driving out things that generate long-term value — like R&D. They use all sorts of excuses when they make those decisions, including the need to please Wall Street and create shareholder value. But they're just excuses for poor thinking.

We need business leaders who have a respect for technical issues even if they don't have technical backgrounds. In a lot of U.S. industries, including cars and even computers, many managers don't think of technology as a core competency, and this attitude leads them to farm out technical issues. But we live in a technical society; technology is just fundamental to our way of life. Technical understanding should be a core competency of any company.

Watch Ed's description about how his firm, Pixar, was and is able to innovate. He is a smart man and I concur with his views. Near term results by the way are NOT at the center of their success but other more important things are. What do you think about that ?